Crypto regulation

The country of Kenya finds itself at a regulatory crossroads as it begins to address the cryptocurrency sector ...

The Emerging Financial Landscape The world of finance is continuously evolving, shaped by nations vying for economic dominance. ...

In a potential landmark shift in policy, South Korean authorities are reportedly considering the legalization of institutional cryptocurrency ...

Bitfinex Derivatives, a renowned digital asset trading platform, announced its plans to secure a cryptocurrency license from El ...

Rostin Behnam, acting Chairman of the Commodity Futures Trading Commission (CFTC), has offered his resignation. The announcement comes ...

The Escalation of Cryptocurrency Fraud Worldwide The idea of a borderless digital economy has attracted countless investors and ...

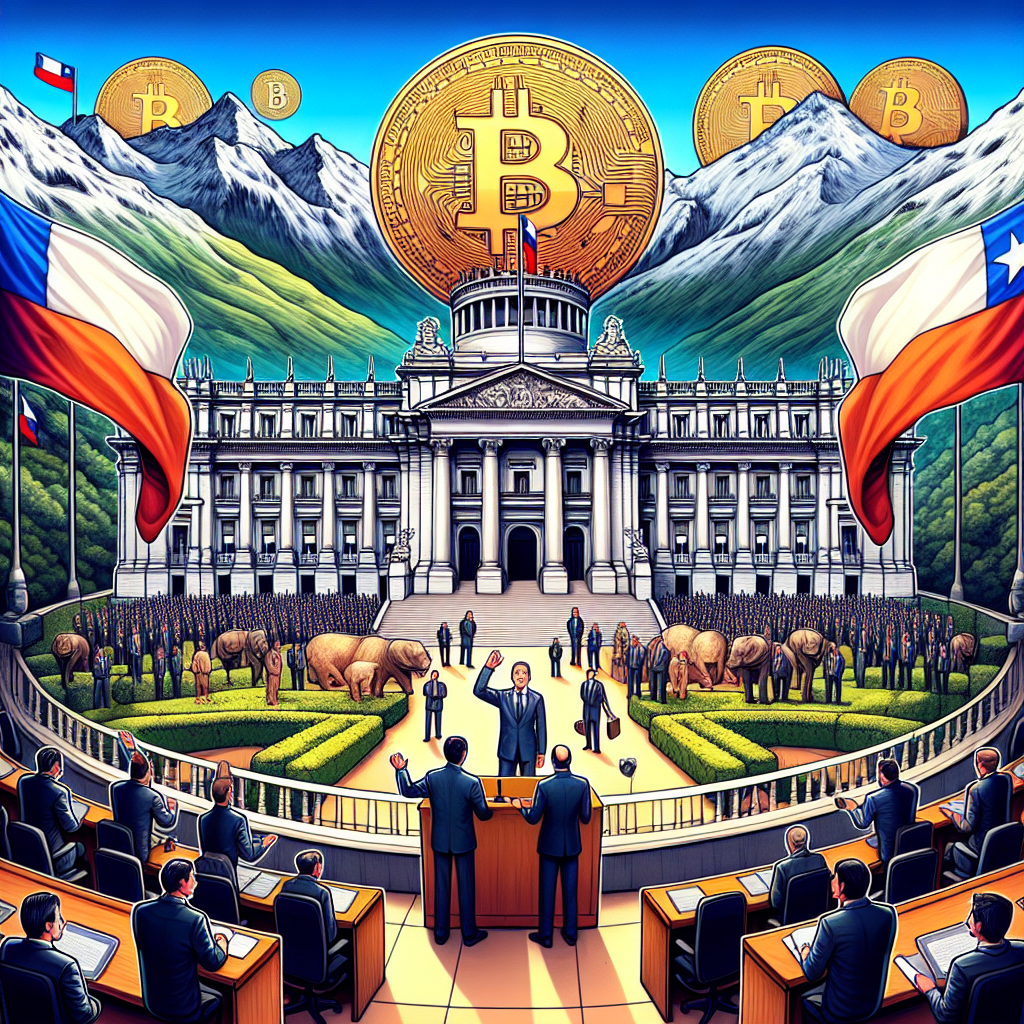

Chile is taking progressive strides by rallying its legislators to consider Bitcoin as a strategic reserve. Evidence of ...

The arena of cryptocurrency and its underlying technology, blockchain, has seen an incredible rise in the last decade. ...

Singapore’s central monetary body, the Monetary Authority of Singapore (MAS), continues to make significant strides in refining the ...

In the rapidly transforming digital economy, executives within the cryptocurrency sector in the United States are optimistic that ...

Singapore’s emergence as an instrumental player in the world of cryptocurrency has taken a new turn. The city-state ...

Chinese financial institutions are tightening their oversight on cryptocurrency transactions as part of a broader effort to curb ...