Tag: blockchain

A Bold Vision for a Digital Future Keir Starmer, the Prime Minister of the United Kingdom, has laid ...

The Growing Concerns about DeFi Security In the world of blockchain and cryptocurrencies, decentralized finance (DeFi) has become ...

About the Devastation In a shocking turn of events, Terra, a thriving network in the crypto world, experienced ...

In an innovative leap forward for waste management and poverty reduction in Africa, trash collectors are now able ...

In a potential landmark shift in policy, South Korean authorities are reportedly considering the legalization of institutional cryptocurrency ...

The Surge of Cardano (ADA) Attracts Whales Cardano’s native cryptocurrency, ADA, has been experiencing a significant increase in ...

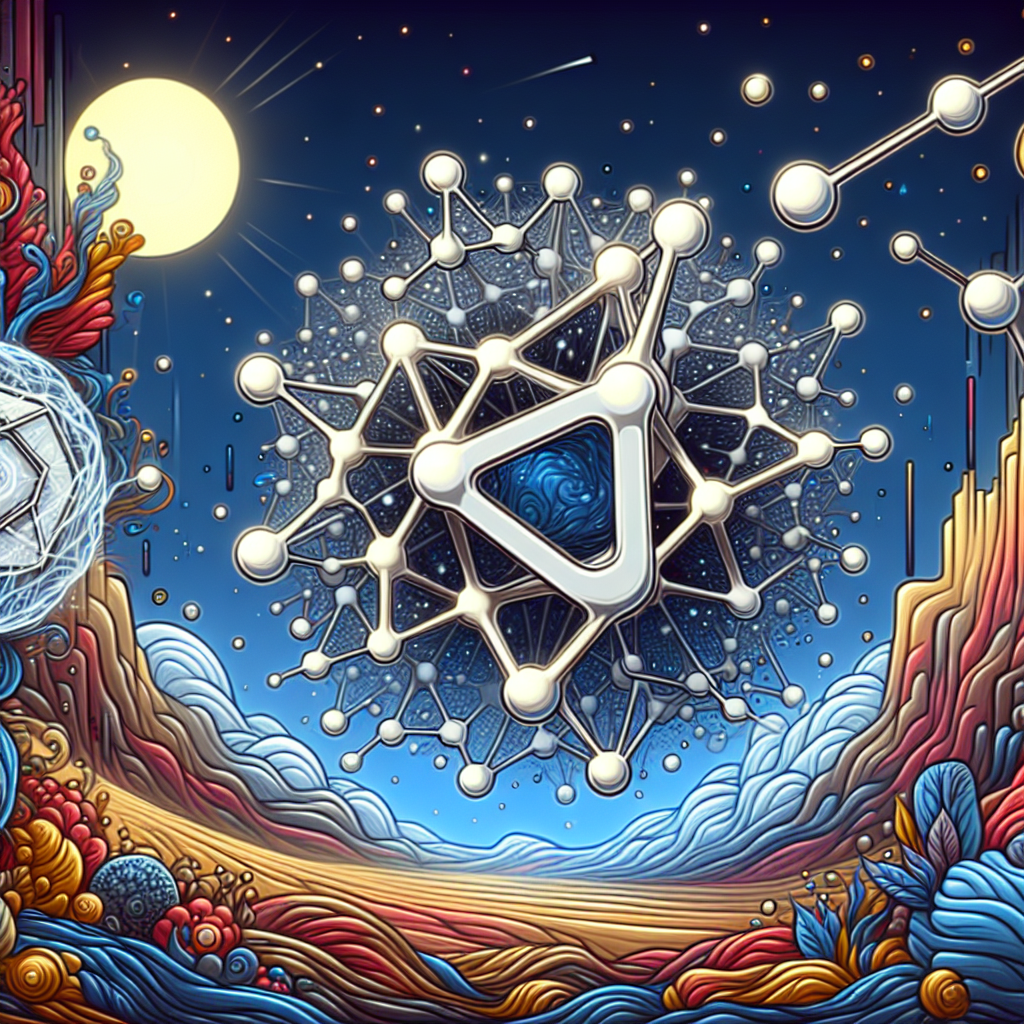

Understanding Quantum-Resistant Tokens: Significance and Implication in the Cryptocurrency Ecosystem

Quantum technologies, particularly quantum computing, have recently been making headlines across various sectors, including the digital currency market. ...

Cryptocurrencies and blockchain technology have seen a steady infiltration into various industries, and the gaming sector is no ...

The leading cryptocurrencies have been recording substantial gains recently, marking the onset of the altcoin season. This period ...

In its global quest to boost cryptocurrency adoption, Ripple, the renowned digital payments protocol, has identified the UAE ...

Introduction It’s an indisputable fact that the venture capital landscape in the crypto world is rapidly changing. As ...

Prediction: $19 Trillion Transactions on the Bitcoin Network The Bitcoin Network, the largest and most well-known digital currency ...