Tag: Digital Currency

Mastercard, a leading global payment solutions company, is stepping up its game in the digital currency sphere with ...

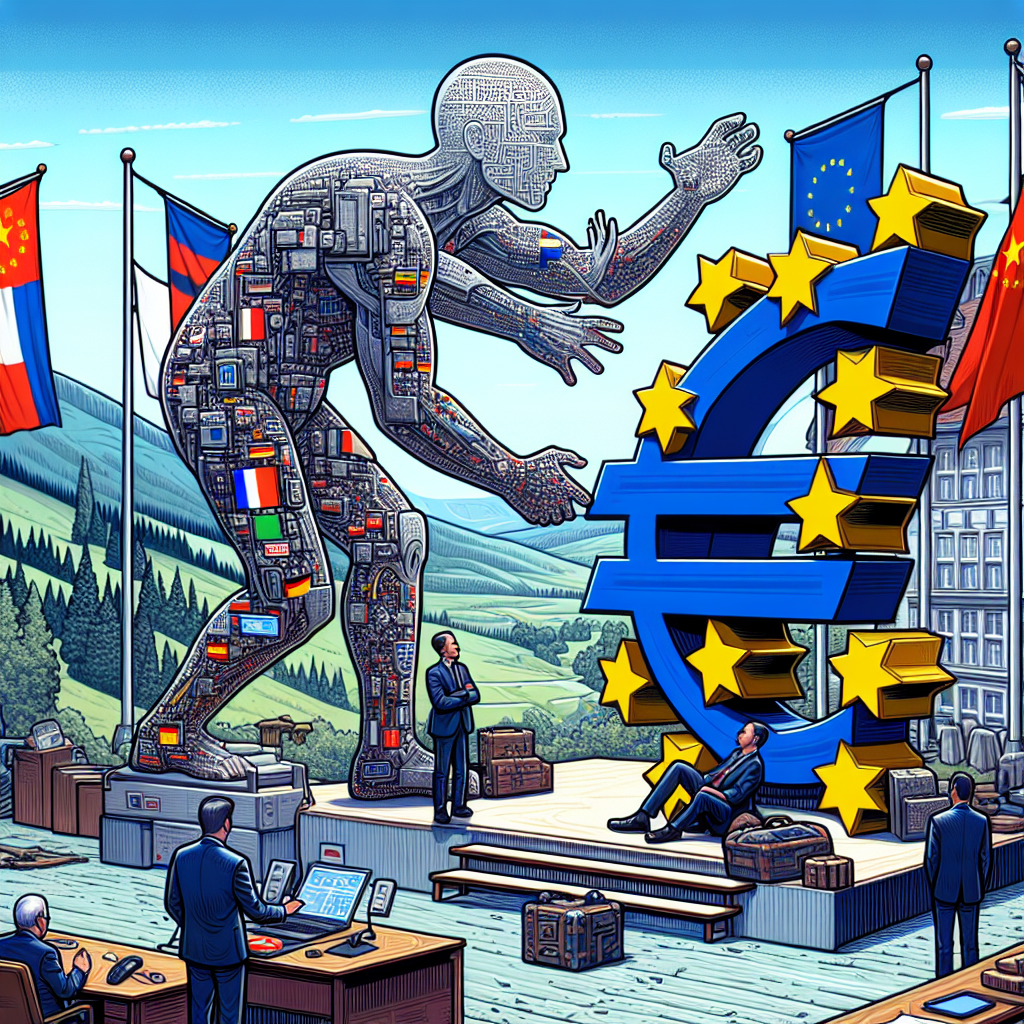

The Emerging Financial Landscape The world of finance is continuously evolving, shaped by nations vying for economic dominance. ...

Prediction: $19 Trillion Transactions on the Bitcoin Network The Bitcoin Network, the largest and most well-known digital currency ...

Turkey’s Garanti BBVA bank, acclaimed as the fifth largest in the country by assets, has revealed its plans ...

Not too long ago, the Euro was seen as a rising challenger to the US Dollar, but the ...

Bitcoin Faces a Market Setback In an unexpected turn of events, Bitcoin – the world’s largest and most ...

The gold repository of El Salvador, a Latin American nation, believed to be worth around $3 trillion, could ...

The Emergence of Stablecoins With the fluctuating nature of cryptocurrencies, stablecoins emerge as a more stable digital asset ...

The Financial Conduct Authority (FCA), the United Kingdom’s primary financial regulator, is probing into the potentiality of instituting ...

The escalating altercation between conventional banks and the nascent cryptocurrency industry has placed the concept of financial liberty ...

The European Central Bank (ECB) has released a comprehensive progress report on its exploration into the incorporation of ...

A Proposed Bitcoin Reserve for the U.S.: Stirred Sentiments Across Social Platforms An emerging proposal suggesting the establishment ...