Tag: El Salvador

El Salvador’s groundbreaking decision to adopt Bitcoin as its legal tender has ignited a tourism boom, a benefit ...

Bitfinex Derivatives, a renowned digital asset trading platform, announced its plans to secure a cryptocurrency license from El ...

Unswayed by its recent agreement with the International Monetary Fund (IMF), El Salvador upholds its Bitcoin campaign, hinting ...

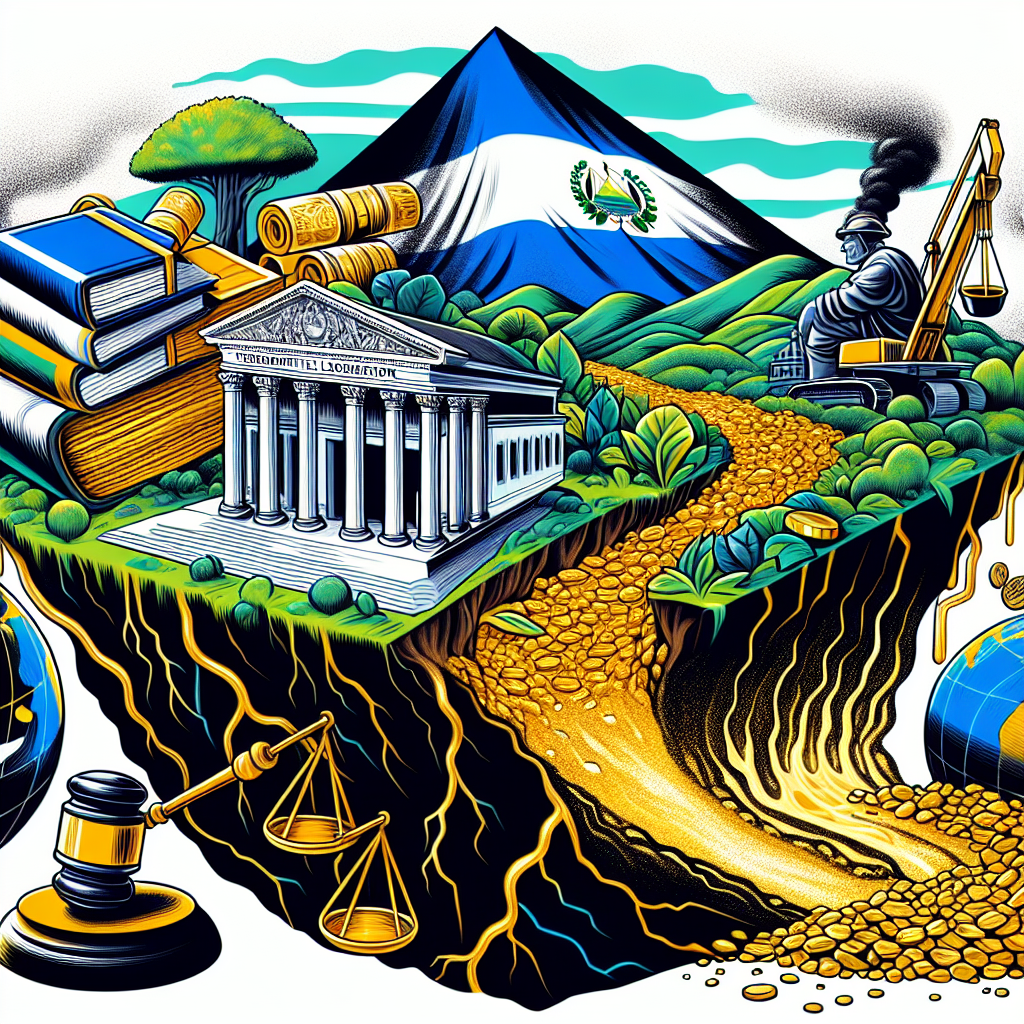

Following the historic move of adopting Bitcoin as legal tender, El Salvador has introduced a new piece of ...

El Salvador’s Bitcoin Accumulation Continues Irrespective of IMF’s Scrutiny El Salvador, the trailblazer in adopting cryptocurrency as legal ...

El Salvador, the first country to accept Bitcoin as legal tender, is showing its steady commitment towards the ...

The gold repository of El Salvador, a Latin American nation, believed to be worth around $3 trillion, could ...

Bitget, a cryptocurrency exchange originating from Singapore, has gained official licensing from El Salvador, allowing it to operate ...

Taking a proactive approach towards crypto regulation, Argentina is partnering with El Salvador to address various digital asset ...

One unique achievement that’s been making headlines in the world of cryptocurrency is the accelerated growth of El ...

In a forward-looking move that signals a new era in digital asset finance, Valora, a decentralized finance (DeFi) ...

Bitcoin’s Strategic Reserve Consideration in Brazil A novel suggestion to integrate Bitcoin (BTC) into Brazil’s financial strategy is ...